Ira distribution tax withholding calculator

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Stock Non-constant Growth Calculator.

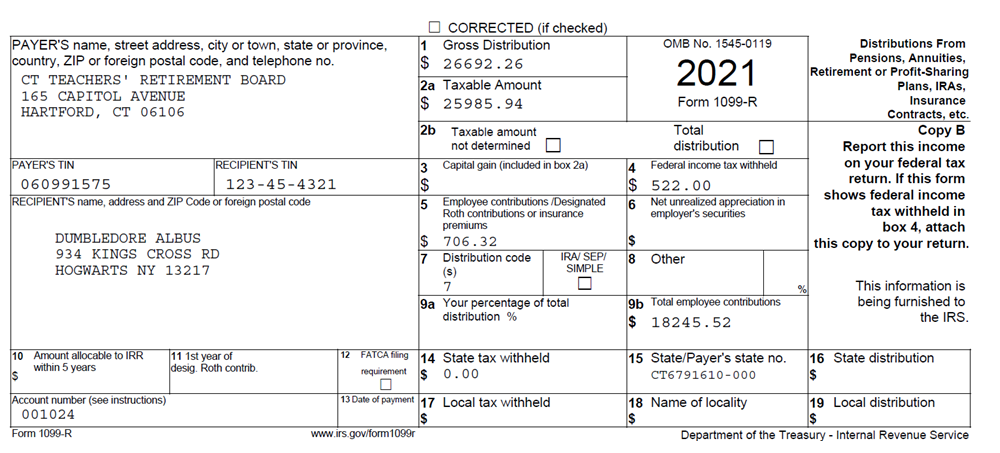

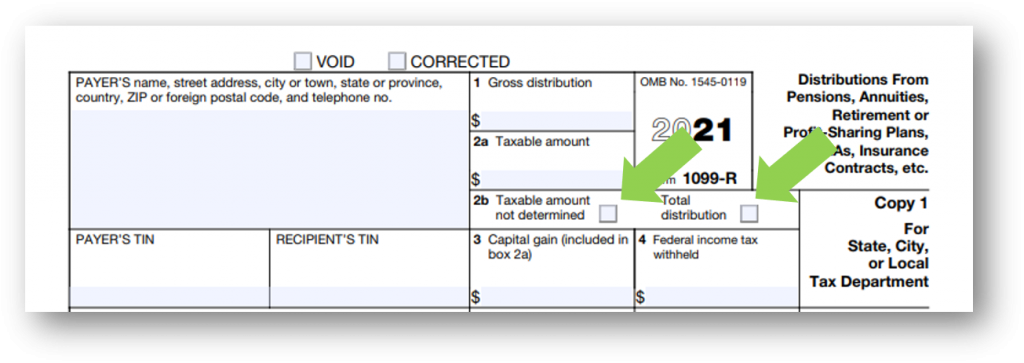

How To Read Your 1099r

If you are under 59 12 you may also.

. Nonperiodic Distributions From an Employers Retirement Plan. For married couples filing jointly the tax brackets are. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Since you took the withdrawal before you reached age 59 12 unless you met one. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

For comparison purposes Roth IRA and regular taxable. Nonperiodic distributions from an employers retirement plan such as 401 k or 403 b plans are subject. 10 12 22 24 32 35 and 37.

If you want to simply take your. The federal withholding tax rate an employee owes depends on their income. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

The reason the default withholding rate is 10 though is that its generally a pretty good measure of the eventual tax liability that a typical taxpayer will owe on IRA distributions. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. When you receive a taxable distribution from an IRA you have the option to have tax withheld from it by the IRA custodian to be remitted directly to the IRS.

Calculate your earnings and more. See how your refund take-home pay or tax due are affected by withholding amount. Use this tool to.

Account balance as of December 31 2021. Subtracting this from 1 gives 085 for the taxable portion of the account. 10 percent for income between 0 and 19050.

If you choose to have income taxes withheld the federal withholding amount is. You will also be prompted to submit a Form W-4P in the request to waive withholding. If you decide to withdraw 10000 multiplying by 085 gives a taxable IRA withdrawal amount of.

Calculate your earnings and more. The federal withholding tax has seven rates for 2021. Your life expectancy factor is taken from the IRS.

Estimate your federal income tax withholding. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Holding Period Return Calculator.

We would like to show you a description here but the site wont allow us. How is my RMD calculated. Weighted Average Cost of Capital Calculator.

This means your taxable IRA withdrawal will be taxed at 24 percent.

Taxes 1099r Forms And W4 Forms

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Withholding For Pensions And Social Security Sensible Money

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Tax Calculator Estimate Your Taxes And Refund For Free

What Does 11 Form Look Like What Does 11 Form Look Like Is So Famous But Why Tax Forms Irs Tax Forms Income Tax Return

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Tax Withholding For Pensions And Social Security Sensible Money

Tax Information Arizona State Retirement System

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Tax Form Focus Irs Form 1099 R Strata Trust Company

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Missouri Income Tax Rate And Brackets H R Block

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

Easiest 2021 Fica Tax Calculator